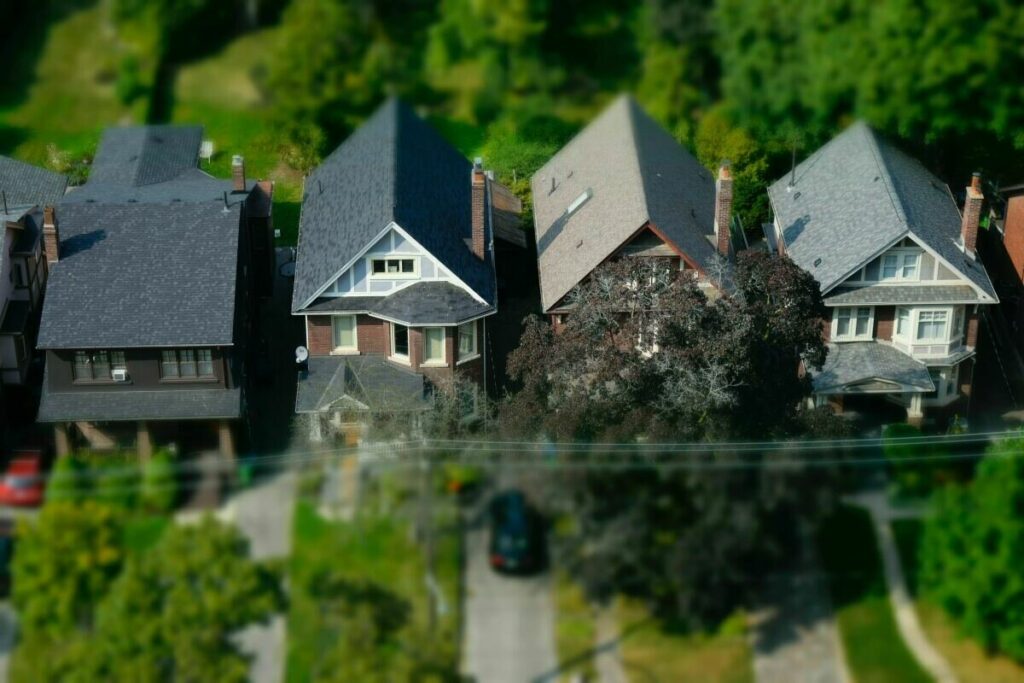

Why Home Insurance Premiums Increase

You sat down with the family and put together a budget, entering values for monthly bills into a spreadsheet. A few months later, parts of the budget are broken already. Expenses have increased, but where?

Insurance could be responsible for part of the increase. Or, it could be the water bill, or the cable bill, the power bill, etc. Often, the only parts of a budget that remain stable are fixed-rate loan payments, which typically don’t change — unless you pay off the loan, refinance, or add more debt. To their credit, many types of life insurance premiums usually remain stable as well.

Other insurance costs can (do) change over time, and these changes can affect home insurance costs as well as auto insurance costs. At the simplest level, insurance premiums reflect risk. Insurers are looking at how likely we are to have a loss, but also how much the loss will cost to cover. The latter of these two is the primary reason for home insurance increases.

A home insurance policy insures the rebuild value of your home. In other words, your policy pays to repair or rebuild your home if you have a covered loss, subject to the policy limit and the deductible you’ve chosen. As rebuilding costs increase, the cost of covering claims also increases. However, that’s not the only factor. Weather and climate-related claims have increased in recent years as well, adding to the increase in both the frequency (how often) and severity (how much) of claims.

So in a market where rebuilding costs increase, possibly coupled with increased climate risk in the region, insurance premiums have to increase over time. Insurers don’t make pricing changes mid-term, however. Any increases, if applicable, happen at policy renewal. This gives policyholders ample opportunity to review their coverage options.

If you’ve received notice of a premium increase at renewal or haven’t discussed your coverage needs lately, reach out to your agent or broker to schedule a policy review. Often, a small increase in premiums can be offset with savings in other areas. But just as importantly, with an insurance review, you’ll rest easy knowing that your coverage is structured to focus protection where you need it most.